Investor Opportunity

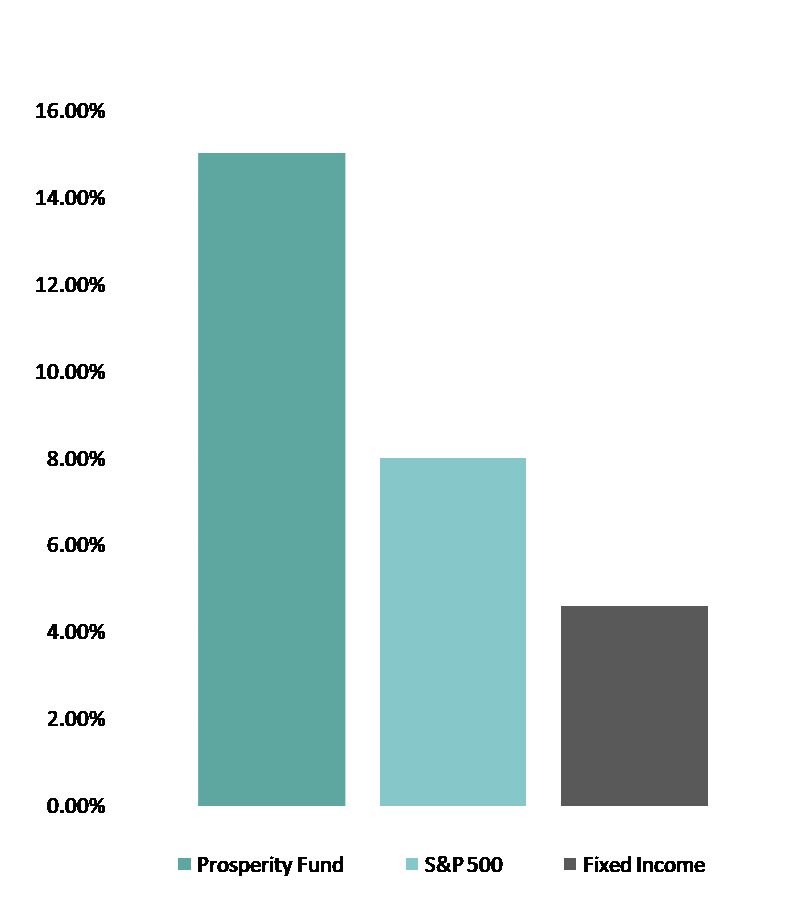

While every investor wants to earn high profits in business, not all achieve it, and even if they did, they took on significant market risk to do so. But imagine a world, where you could make double-digit returns without the traditional market risk. Prosperity Life Fund has created a proven platform to return investors with double-digit returns, that do not carry the traditional market risk. While markets fluctuate consistently, Life Insurance-backed Assets provide a more secure alternative. We accomplish this goal by selectively buying A-rated life insurance policies from seniors who no longer want, need, or can continue to afford the high costs of their insurance premiums via strategic investments in life settlements.

With Life Settlements Prosperity policyholders who no longer want, need, or can continue to afford the high cost of their life insurance premiums, can sell all, or even a portion of their life insurance policy to Prosperity Life Fund for more than the policy cash surrender value back to the insurance company, but less than the total life insurance policy benefit. The policy is then acquired by Prosperity Life Fund who continues to fund the remaining premiums and thereby collects the total policy benefits afterward. Thus, the purchaser receives a secure non-market correlated asset for their portfolio, which can achieve double-digit returns, while the policyholder receives the much-needed capital for their family and their needs.

With Life Settlements Prosperity policyholders who no longer want, need, or can continue to afford the high cost of their life insurance premiums, can sell all, or even a portion of their life insurance policy to Prosperity Life Fund for more than the policy cash surrender value back to the insurance company, but less than the total life insurance policy benefit. The policy is then acquired by Prosperity Life Fund who continues to fund the remaining premiums and thereby collects the total policy benefits afterward. Thus, the purchaser receives a secure non-market correlated asset for their portfolio, which can achieve double-digit returns, while the policyholder receives the much-needed capital for their family and their needs.

According to the Life Insurance Settlement Association & The Insurance Studies Institute :

90% of seniors who lapsed or surrendered their policies (Totaling Over $100 Billion in Assets each year) back to insurance carriers would have considered selling their policy if they were aware that possibility existed. Thus, there is tremendous opportunity in this underserved marketplace for life settlement investments. In total, there are 38 Million life insurance policies for seniors, totaling 3 Trillion+ in collective value.

$112 Billion

of senior-owned life insurance policies are surrendered to Insurance Co. every year

90% of Seniors

whose policies are surrendered would have considered selling their policy if they knew how (LISA)

Legal, Actuarial, & Strategic Benefits

As per the Supreme Court (Grigsby v. Russell, 222 U.S. 149), life insurance was deemed to be an asset which carried with it all rights of valuation & sale. Thus, life settlements are backed by sound legal precedent. Furthermore, according to LISA, 43 states and the territory of Puerto Rico regulate life settlements, affording approximately 90% of the United States population protection under comprehensive life settlement laws and regulations.

Additionally, life settlements have been recently experiencing a major renewal with new & updated medical underwriting models, excited investor interest, and an expanding policy supply. The industry continues to rapidly grow.

Using Prosperity's proven and proprietary strategic algorithm, Prosperity Analytics, in combination with 3rd party actuarial analysis of the insured’s medical records, non-market correlated life insurance policies are purchased with the expectation of significant financial returns, without the associated traditional market risk and fluctuation other investments carry. These returns can also provide a hedge against unpredictable markets, create wealth, and promote financial security.

Additionally, life settlements have been recently experiencing a major renewal with new & updated medical underwriting models, excited investor interest, and an expanding policy supply. The industry continues to rapidly grow.

Using Prosperity's proven and proprietary strategic algorithm, Prosperity Analytics, in combination with 3rd party actuarial analysis of the insured’s medical records, non-market correlated life insurance policies are purchased with the expectation of significant financial returns, without the associated traditional market risk and fluctuation other investments carry. These returns can also provide a hedge against unpredictable markets, create wealth, and promote financial security.