Here’s a story about Maggie

- Maggie is an 83-old Grandmother in NY

- Holds a 2.5 MM Life Insurance Policy with ING

- Facing a sudden $35K annual premium she cannot afford

- Will only receive 20% of policy value upon surrender

Prosperity Life Fund has a better solution.

We provide improved financial outcomes for Seniors who can no longer afford their Life Insurance policy.

Life Settlements: How It Works

Maggie Sells either:

- Entire policy

- A Portion of Policy

Prosperity Purchases Policy, Pays Premiums, & Receives Benefit

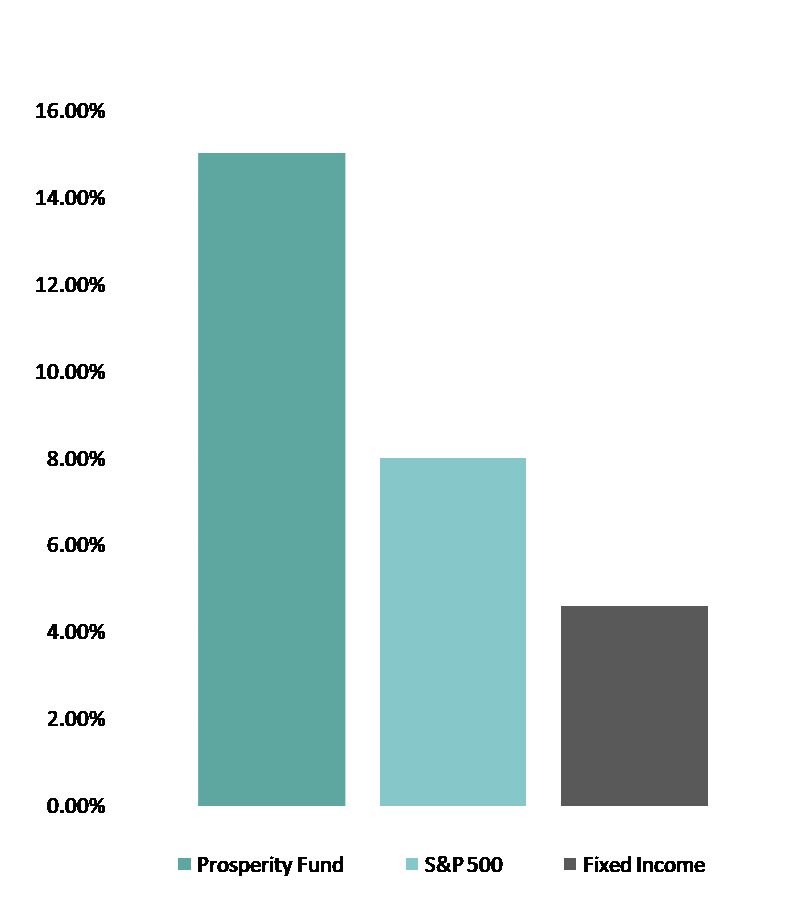

Investor Receives Double-Digit Return

Maggie’s Success with Prosperity

With Life Insurance Co.

- Receives Minimum Surrender Value

- Only Receives 20% of Policy Benefit

With Prosperity Life Fund

- Receives $275,000 More For Policy

- Receives 55% Increase over Insurance Co.

Untapped Market Opportunity

$112 Billion

of senior-owned life insurance policies are surrendered to Insurance Co. every year

90% of Seniors

whose policies are surrendered would have considered selling their policy if they knew how (LISA)

Investor Opportunity

Our Advantage

- Double Digit Returns, Without the Traditional Market Risk

- Selectively target A-rated Policies [Past Contestability Period]

- Utilizes Prosperity Analytics + 3rd party Actuarial Data

- Portfolio of Policies Provides Market Hedge for Investors